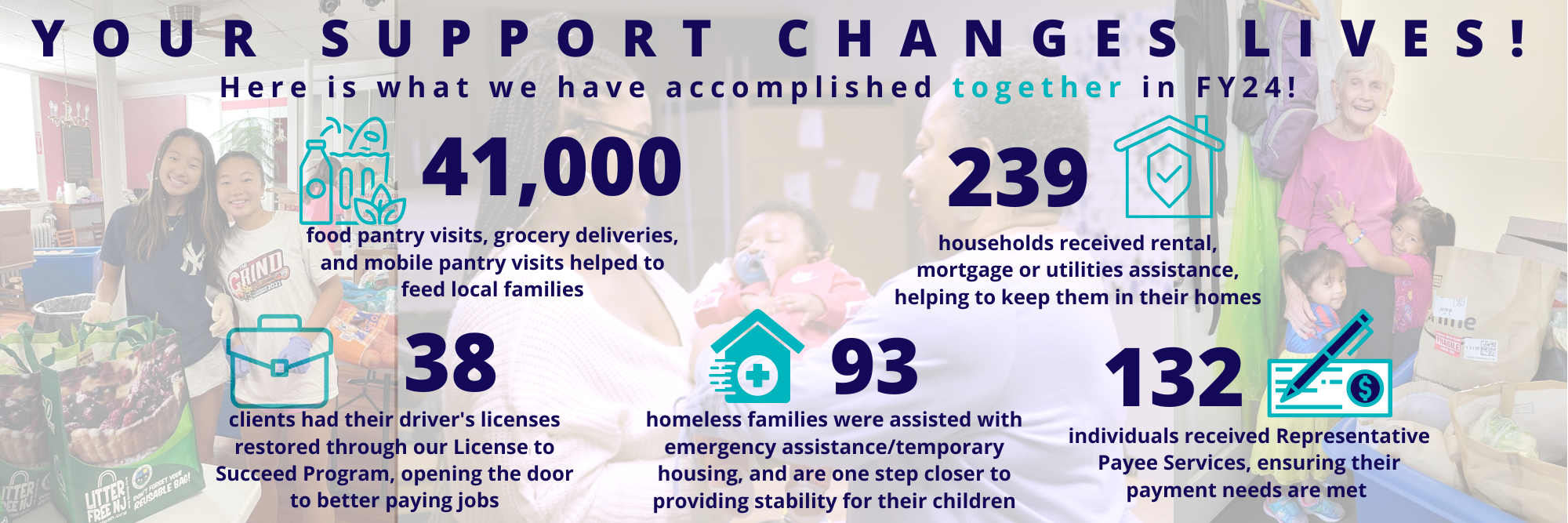

Right here in Mercer County, families you know are facing extensive hardships, forced to choose between food to eat or a place to live, buying diapers or keeping the lights on. These are families we see in our schools. Pass in our stores. Sit next to in our places of worship. Wave to on our street. Now more than ever, these families need you.

How can I make a donation?

Use the donation form on this page, or mail your check to: Arm In Arm; 1 N. Johnston Ave., Suite A230, Hamilton, NJ 08609

Is this donation tax deductible?

Arm In Arm is a 501(c)3 tax-exempt organization and your donation is tax-deductible within the guidelines of U.S. law. To claim a donation as a deduction on your U.S. taxes, please keep your email donation receipt as your official record. We’ll send it to you upon successful completion of your donation.

Can I make a donation of stock?

Yes! A charitable gift of appreciated stock provides tax savings by allowing you to avoid capital gains tax you might incur with the sale of stock and may offer you a charitable deduction based on the stock’s current value. Contributions to Arm In Arm, a tax-exempt organization under Section 501(c)(3) of the Internal Revenue Code, are deductible to the fullest extent of the law.

Transfer to: RBC Capital Markets LLC; DTC # 0235; Account Number: 30249400

For credit to Arm In Arm; Tax ID #: 22-3198464

Can I make a donation of cryptocurrency?

YES! To donate cryptocurrency to Arm In Arm, click here

Will my employer match by donation?

Thousands of employers match donations of money or time by their employees, essentially doubling the impact of employee contributions. Matching requests must be initiated by you as the donor or volunteer. Some employers require paper completion of paper forms, while others have a process for electronic submission. For questions, please contact Executive Director, Maureen Hunt, maureenh@arminarm.org, 609-396-9355, x15

How will I receive an acknowledgment for my donation?

You should receive a receipt /acknowledgement of your donation either electronically at the email address you provided, or via USPS Should you need further assistance, please email maureenh@arminarm.org

How do I make a gift in honor or in dedication to someone?

On the donation page, check the box next to where it says: Dedicate my donation in honor or in memory of someone. If your honoree has an active email address, you may include it there to send an optional message to your honoree.

Can I make a planned gift?

YES! You can help to secure Arm In Arm’s future by designating a gift or portion of your estate with a bequest:

- Charitable Remainder Trust. You can place assets in a trust that pays annual income to you (or another named beneficiary) for life. After your lifetime or a term of years, the remainder of the trust can be transferred to Arm In Arm.

- Charitable Lead Trust. You can place assets in a trust that pays a fixed amount to Arm In Arm for the number of years you select. Once this period ends, the assets held by the trust are transferred to the beneficiaries you name.

- Retirement Plan/Life Insurance. You can name Arm In Arm as the designated beneficiary of a retirement plan or as the designated beneficiary, or partial beneficiary, of a life insurance policy.

- Charitable Planning with your IRA. If you are 70½ or older, and therefore required to withdraw monies from your IRA every year, a provision allows you to redirect your IRA contributions to charitable organizations like Arm In Arm.

- Real Estate – Please contact us to discuss a gift real estate or other property to Arm In Arm.

Please contact Executive Director, Maureen Hunt at maureenh@arminarm.org 609-396-9355 x15.